Budgeting Tips That Will Increase Your Revenue

LISTEN TO THE EPISODE — APPLE | SPOTIFY | YOUTUBE

When you’re running your own business, it’s easy to have money on your mind. It’s not always everyone’s favorite activity but it’s always helpful to do… this week’s episode is all about keeping a budget! When it comes to budgeting, we all know that as a business owner you need to be tracking your expenses. Are there more numbers you should be tracking? Well, we’re here to tell you all about it!

In this episode, we share the different numbers we track not just to stay within budget but also to find ways to increase our company revenue.

Creativity vs. Numbers

We’re definitely not saying this is the case for everyone but we know for us and many others, we didn’t usually get into the business by numbers-driven. Most of us get into the rental business because we love the creativity that comes with it. However, operating as a rental company for over 10 years we have adapted and recognized how to track our numbers, and which numbers, really benefit us as a company. Several different resources or freebies can be found on our website to help you track your numbers.

With the launch of Rental Biz Academy going on right now, there are even more resources available to set yourself up for success, including the budgeting spreadsheet we use in the office.

“Most of us start this business because of the love of creativity.” – Cam | Render Founder + CEO

Business Expenses to Budget for

First things first, start now! Our recommendation would be to start tracking your budget yearly, beginning in January. Section out your expenses into categories for the ways you’re spending money: banking fees, bookkeeping, accountants, maybe even a CPA. Other things to think about are what you need in order to run your business: software, operations, inventory management system, email software, phone systems, time tracking, task management system.

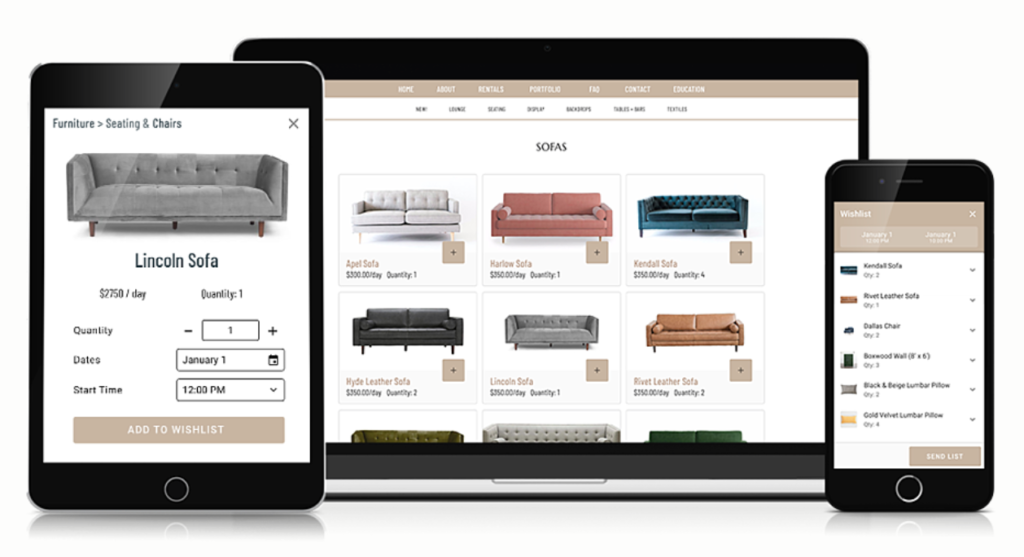

Sidebar…. you cannot run your rental business without a good inventory management system! We use GoodShuffle Pro and highly recommend it for many reasons.

Other things you may purchase would be tools or software to help you market your business. An example here is Planoly. There are also brand marketing materials such as business cards, lookbooks, doing the lookbook-styled shoot, etc.

Above all else, we believe you need to have a website for your business. You cannot just rely on social media. Anywhere on social media can be tricky. There are no links to show all of your inventory to potential clients. There are no SEO capabilities when operating only off of social media channels. We highly, highly, highly recommend having a website! We’re not saying it’s impossible but we want to encourage you.

Storage for Your Product

Maybe you have a warehouse. Woohoo! But like everything else in life, even if it’s your’s there are probably still additional expenses. Rent, water, gas, electricity, potentially the internet are all costs that could’ve been accounted for. Say you are paying for a storage unit instead or as an additional expense. These are all more things to build into your yearly budgeting spreadsheet.

One thing to note… if you are still storing items in your personal residence (home, garage, etc.) you can note how much square footage you are using to store and write them off for your taxes!

Automobile expenses (gas, insurance, car note, registration, tolls, etc.) for you or your rental vehicles should also be noted for your yearly budget. Fortunately, if you are using your personal vehicle more than 50% of the time for your business, you can write that off too!

To finish off the expense side. There is any type of networking cost, membership, or organization. You also have payroll. Be mindful of your monthly budget to account for how much you need to be paying yourself or your team. Separate all your expenses into the month, quarter, and year. This is beneficial for how you may pay your taxes.

Revenue

Based on what you do, we separate this into three different ways. First, what type of event is bringing this in? Here at Render, we do corporate events, social events, and weddings. So we start by asking, “Which category would this fall into?” Secondly, you can also separate it by inventory! What products, the logistical revenue, etc. Lastly, if you are offering more than one service, our team recommends noting the difference in revenue between your services. this allows you to see which one is more lucrative.

Tip: we like to look ahead and ask, “what are our projected numbers?” However, instead of looking at what we may be spending, we can think about what amounts we will be bringing in and that we can use to buy additional products for different events.

Whether you listen to this full episode or not, key areas you should tune into that we discussed are listed here:

[7:28] What Numbers Do You Need To Know?

[12:03] You Need A Website!

[14:21] Tax Write-offs You May Not Know About.

[18:52] 3 Ways to Separate Your Revenue.

Product or Affiliate Links — Rental Biz Academy | Goodshuffle Pro | Planoly

Next week we will drop an episode about how you can “love” your clients well. Be sure to subscribe so you always get our latest episodes!

Joyfully,

TJ White | Content Manager

We'll keep you up-to-date on our newest resources + latest episodes.

JOIN OUR COMMUNITY

I thrive on using education to make true connections with all kinds of people. I want to point you towards better leading your teams, and guide you through all areas and stages of your business. I put a heavy emphasis on being present where your feet are, creating a community that is diverse and intentional, and growing in servant leadership through both my personal and professional life.

what makes us different

1101 Quaker Street

Dallas, TX 75207

*by appointment only please

VISIT

We'd love to keep you in the loop about our latest offerings!

Join the Community

stay updated

CONNECT

Email us: educate@therender.co

We have multiple types of educational routes to best fit your needs.

EDUCATION

Call us: (214) 438-4775

© 2023 Render // Site Credits // Privacy Policy